The financial information in Deezer’s filing for a public stock offering provides rare transparency into a standalone music subscription service’s challenges and weaknesses. While the public has limited information about Spotify’s financial performance and detailed information about its licensing contract, it hasn’t had this kind of insight since Napster’s last quarterly earnings release back in late 2008 — and that was a different era for subscription services.

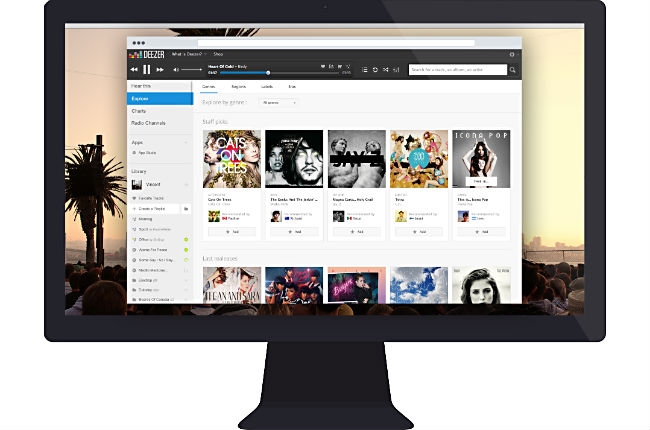

Deezer, an on-demand subscription service available in about 180 countries, has filed for an initial public stock offering on the Paris stock exchange. Analysts believe the IPO will value the company at about €1 billion, according to reports, about the same number Deezer was reportedly chasing when seeking additional funds from investors earlier this year.

The big question is will investors put money into a company that currently pays over three-quarters of its revenue to rights holders (more on that below) and doesn’t generate revenue on two out of five subscribers (more on that below, too)? After all, licensed music services are a notoriously tricky business — even for the more successful ones.

The good news is Deezer is growing fast. Revenue grew 52.9 percent to €141.9 million in 2014. That’s faster growth than last year’s 39 percent growth in the overall global subscription business, according to the IFPI. The company’s revenue grew 46.0 percent in 2013. The momentum has fallen only slightly in 2015 as first-half revenue rose €40.9 million to €93.2 million. Revenue in the 12-month period ending June 30 was €169.0 million.

The bad news is content costs have eaten nearly all revenue. As a percent of revenue, Deezer’s cost of sales — a close estimate of royalty costs — fell to 84.4 percent last year from 97.6 percent and 91.3 percent in 2013 and 2012 respectively. This number if headed in the right direction, however, falling to 82.3 percent in the first six months of 2015 and 82.6 percent in the 12-month period ending June 30.

To make matters worse, Deezer has been subject to some of the same deal points seen in leaked Sony Music contract with Spotify. Deezer’s deals with labels include minimum guaranteed payments — some paid as advances — that were larger than expected royalty payments from 2012 to 2014. As a result, Deezer’s paid rights holders amounts in excess of accrued royalties by €2 million in 2014, €13.3 million in 2013 and €5.4 million in 2012.

Reigning in royalties isn’t easy. As is typical, some of Deezer’s contracts have most favored nations clauses that allow a party to see contracts with other parties and, in some cases, demand more favorable terms, in turn reducing Deezer’s margins.

But there is upside here. Deezer is a growing business, and one of the largest, in a growing, disruptive market. That’s a pitch investors like to hear.

A subscription service needs to achieve the proper scale to offset its costs. This is a realizable goal. The subscription market is in a nascent phase. Consumers are still learning about paid access models. The IFPI estimates there were 41 million people paying for music subscription services globally in 2014. Such a small number suggests subscription services have captured little of the potential market.

Unfortunately, it appears Deezer isn’t there yet. As of June 30, 2015, it had 6.3 million subscribers, 2.2 percent lower than the tally a year earlier. That was actually lower than the 6.8 million subscribers Deezer had at the end of 2014. The decline occurred because Deezer started emphasizing standalone subscriptions, not subscriptions bundled with a mobile service, in its partnership with mobile carrier Orange in France. In addition, subscribers in the smaller “rest of world” category declined 45.1 percent, to 100,294 from 292,192, because a contract with an Asian mobile carrier was not renewed.

But there’s a bigger problem: 40.2 percent of Deezer’s subscribers don’t generate revenue for the company. At the end of June, the service had 2.5 million non-revenue-generating “subscribers” and 3.8 million revenue-generating subscribers. As explained in the filing, some of Deezer’s licensing deals pay “primarily based on the total number of monthly active bundle subscribers.” In other words, inactive subscribers are not valuable subscribers.

Fortunately, Deezer is trying to fix the problem by switching its emphasis to standalone subscribers (and less dependence on mobile carriers). This tactic appears to be inflicting some short-term pain. For example, Deezer’s revenue-generating subscribers actually declined from December 31, 2014 to June 30, 2105 because of this shift toward standalone subscriptions. In Latin America, a change in contracts with mobile carriers resulted in a sharp decline in total revenue-generating subscribers. In Europe, however, a fall in revenue-generating inactive bundle subscribers was more than offset by the gain in standalone subscribers.

Now is probably the best time for Deezer to plan an IPO. Its financials aren’t the most attractive, but the window of opportunity is still open. Apple Music launched nearly three months ago and could quickly surpass Deezer as the second-largest music subscription service. How many of its 15 million free trial users will become subscribers is up for speculation, but Apple Music should get an additional boost from iOS 9 released earlier this week and the coming release on Android. Spotify has a big lead (20 million subscribers) and shows no sign of slowing down. A competitive market is going to get more competitive. Deezer needs to make a move before the window shuts.