The music business has a wait-and-see attitude about Apple Music, but investors have already started to place their bets. Shares of Internet radio company Pandora have fallen 12.2 percent since the last closing price before Apple debuted its new music-streaming service on June 8.

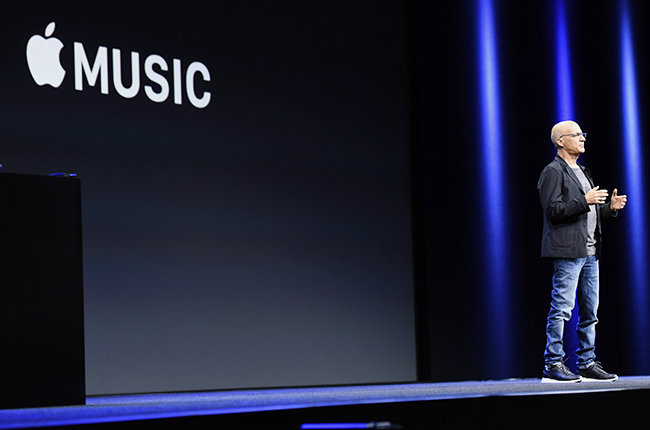

Apple Music — which launches Tuesday — will feature a radio-like, 24/7 station called Beats 1 that will be available to anybody who downloads the app (outside of a three-month free trial, only subscribers get access to the on-demand service). Apple has secured plenty of press for Beats 1 leading up the launch, and investors seem to have take notice.

Not all of Pandora’s decline can be attributed to Apple Music: Monday (June 29) was the first full trading day for investors to digest a $210 million settlement between SiriusXM Radio and record labels related to royalties for pre-1972 recordings. The settlement resolved a lawsuit brought against the satellite radio company by the act Flo & Eddie for nonpayment of recordings created before 1972. Pandora was sued by Flo & Eddie last year for the same reason.

Some of Pandora’s decline on Monday can also be attributed to a decline in markets around the world caused by the Greek financial crisis. The New York Stock Exchange, on which Pandora trades, fell 2.3 percent compared to Pandora’s decline of 2.9 percent. The correlation doesn’t extend back to June 8, however. Since Apple Music’s debut, the NYSE is down just 1.2 percent.

Nevertheless, sentiment about Pandora appears to be clear. Its shares have fallen on nine of the last 15 trading days, shaving off more than $2 per share, or roughly $450 million in market capitalization. Right or wrong, some investors see Beats 1 as a threat to Pandora’s growth and have lowered their expectations accordingly. The world will have a clearer opinion on Tuesday.