Physical album sales might have fallen across America in the first half of 2015, but independent retailers are bucking the trend.

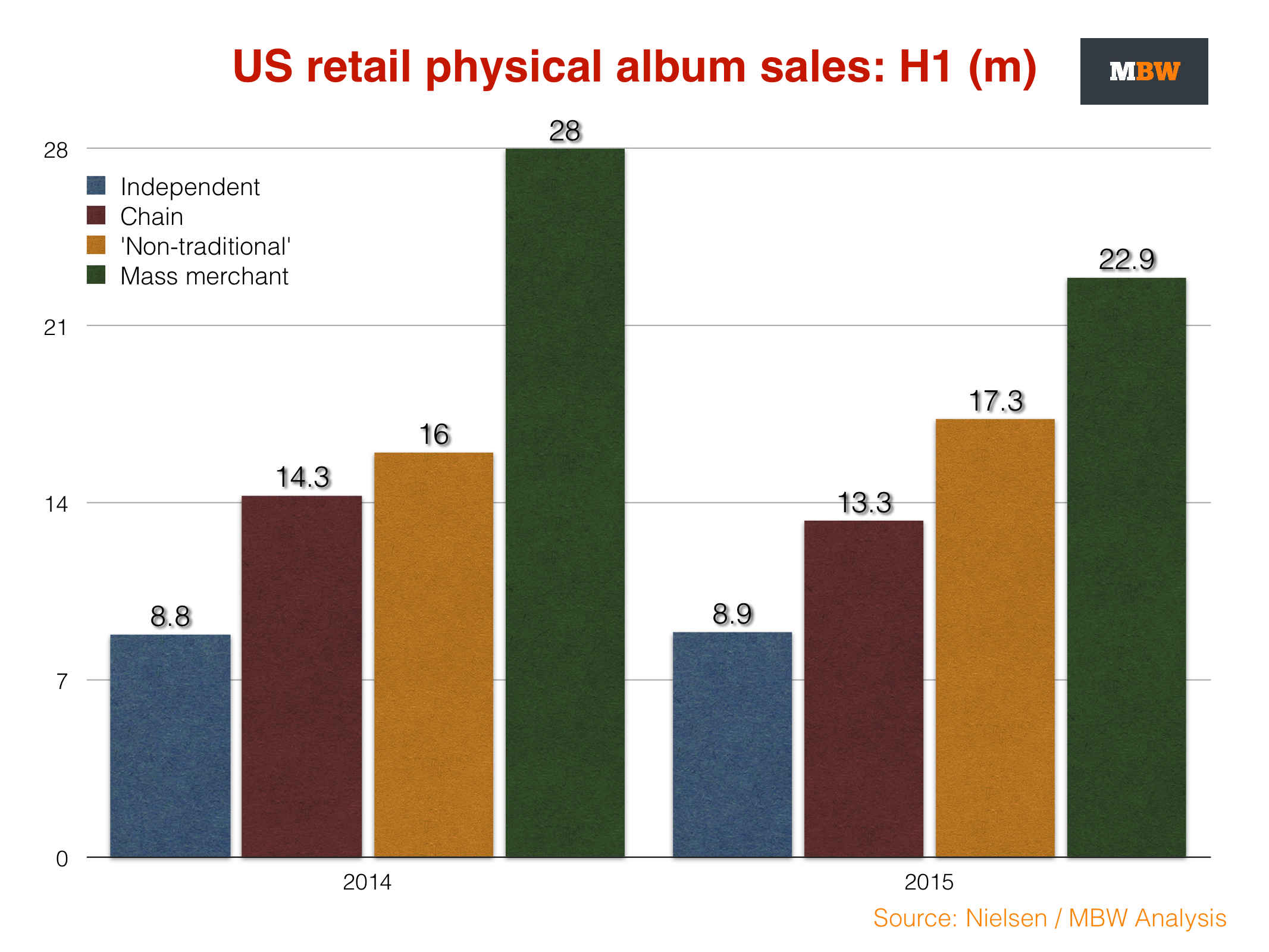

US indies saw CD/vinyl/cassette album sales increase 0.6% year-on-year from Jan-June, according to new stats, up to 8.9m.

And they weren’t the only retail category that enjoyed a rise in sales.

What Nielsen Music calls ‘non-traditional’ retail – including D2C activity, as well as online operators like Amazon – jointly saw sales rise from 16m in H1 2014 to 17.3m in the same period of 2015.

That’s a significant jump of 8%.

Wait a second… isn’t the CD supposed to be dying?

How come the entire US CD albums market dropped 10% in the first half of 2015 if everything’s hunky dory at indies and Amazon?

Because the format’s falling off a cliff at ‘mass-merchant’ retail like Walmart.

According to Nielsen’s stats, physical album sales at this category of retailer fell by a massive 18.2% in H1 2015, down to 22.9m.

Chain entertainment retailers also felt a drop, by 6.8% to 13.3m.

The fact that mass market retailers sold almost 1/5th fewer CD albums than they did in H1 2014 is almost certainly having a detrimental effect on one area of the market in particular.

There will be deeper analysis on MBW to come on this, but below you can see the decline of physical album volumes according to US mid-year stats over the past five years.

We encourage you to cast your eyes between 2014 and 2015, and witness the relative stability of the year-on-year catalogue physical albums market (down 0.9m) and the current albums market (down almost 3m).

Despite all of the declines in both categories over the past half-decade, catalogue sales volume of physical albums were further ahead of new albums in H1 2015 (by 3.4m) than they’ve been at any other point on the chart. [Music Business Worldwide]