Thought that we’d be given some official updated Apple Music subscriber numbers by now?

Not likely.

Apple’s Eddy Cue said in August that 11m people had signed up to the free three-month trial of the streaming service, two months after it launched on June 30.

Since then, we’ve heard wildly varying estimates of the number of subscribers Apple has retained: some suggest it’s as low as 50%, while the Cupertino firm has argued that it’s closer to 80%.

The number of active Apple Music users who signed up to the app on June 30 is bound to have tumbled downwards in the past week; it’s the first time that these early adopters have been forced to make a choice between paying a monthly subscription, or quitting.

Any lack of transparency when it comes to Apple Music’s user numbers are something of a frustration for industry watchers such as MBW, because it makes a direct comparison with Spotify more difficult.

(At the last count, Daniel Ek’s Swedish-born streaming app had exceeded 20m paying subscribers and 75m total active users.)

It’s also impossible to use industry-standard download counters like App Annie to contrast the popularity of Spotify and Apple Music, because the latter is a native first-party iOS app.

So where can we turn for a fair apples-to-Apples juxtaposition?

Well, there’s always Google.

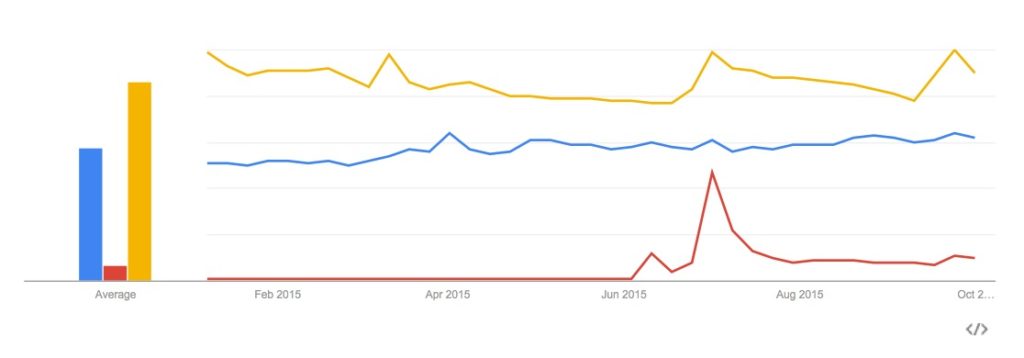

MBW has been busy taking a look at how the frequency of searches for ‘Apple Music’ have stacked up against ‘Spotify’ over the past few months – both on a worldwide basis and in terms of some of the most important markets.

Industry whispers suggest that there’s a huge pre-Christmas marketing blitz coming from Apple in the next few months for its streaming platform. Looks like it might need it…

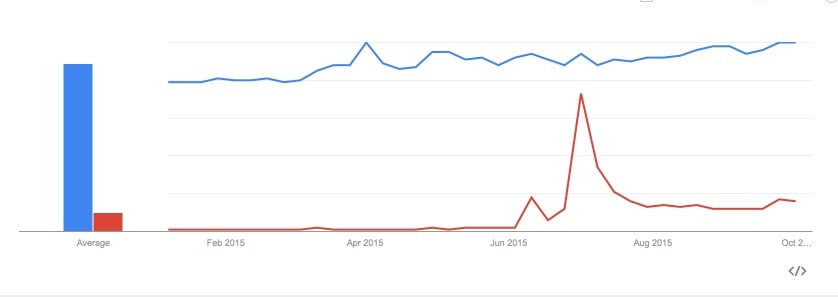

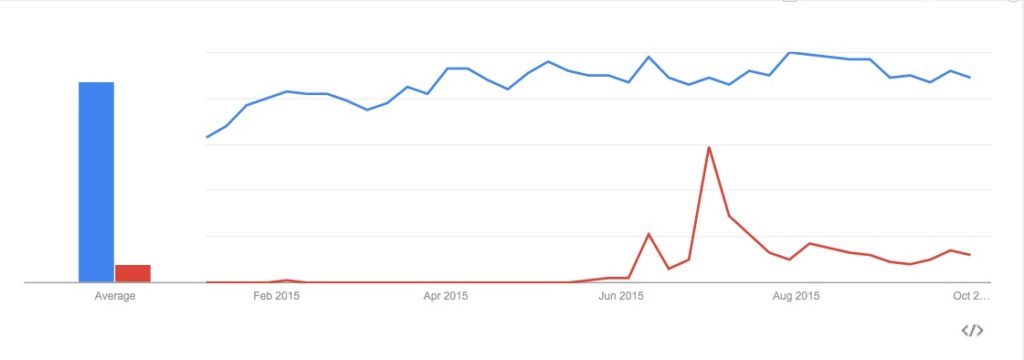

WORLDWIDE

The graph above shows the search popularity of ‘Apple Music’ (red) and ‘Spotify’ (blue) across the globe this year.

We don’t get a specific total or per-capita search number to analyse, but the gulf between the two services as we head into October is clear.

The two spikes you see for Apple were driven by major news events: the announcement of Apple Music at WWDC in early June, and the launch of the platform on June 30.

Another noteworthy trend: Spotify’s boast that it’s only become more popular in the wake of Apple Music’s launch appears to be true, although not by a particularly chunky margin.

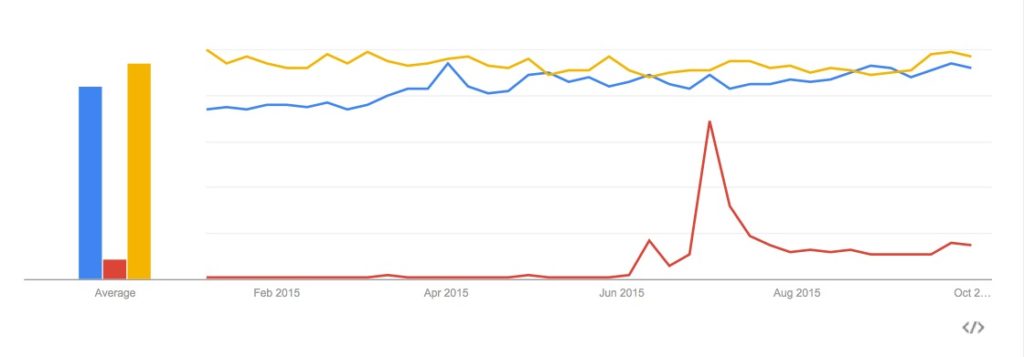

Also, Spotify isn’t Apple Music’s only rival.

Apple still owns another giant of digital music in iTunes, and according to these results, its brand awareness hasn’t dissolved in 2015 very much at all.

When you throw iTunes into the mix (yellow line), it even dwarfs Spotify.

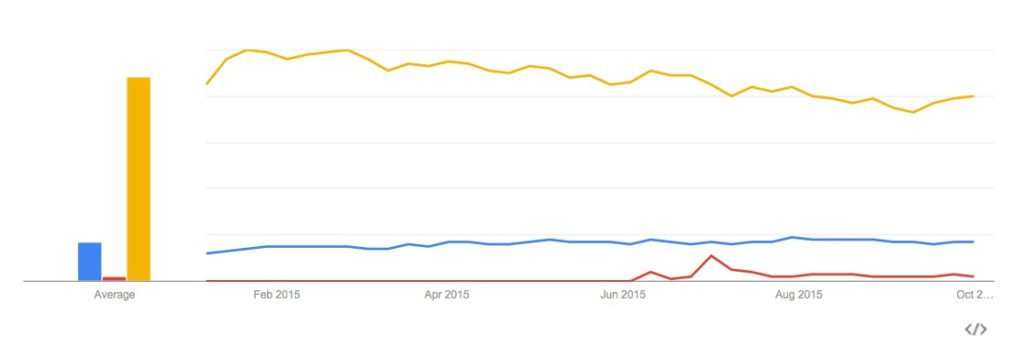

Another worthwhile addition to the data is Google Play.

Another worthwhile addition to the data is Google Play.

The specificity of the name of the company’s streaming/download store – ‘Google Play Music’ – is a hindrance for any like-for-like comparison here.

But it’s perhaps worthwhile to at least get a sense of how ‘Google Play’ is faring (yellow below, with Spotify in blue and Apple Music in red).

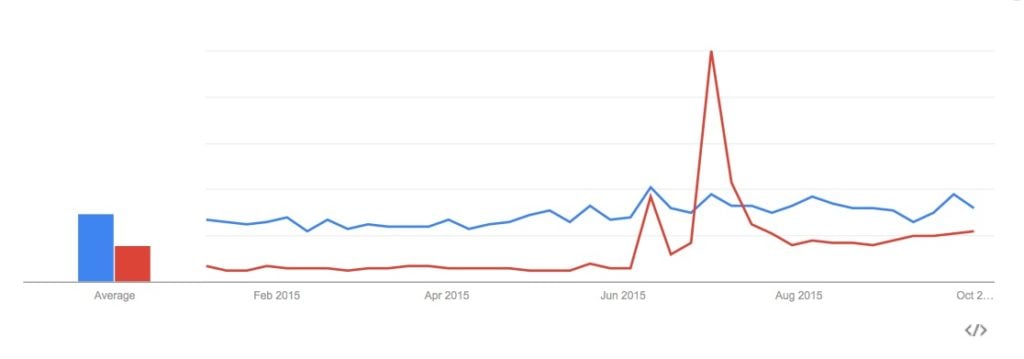

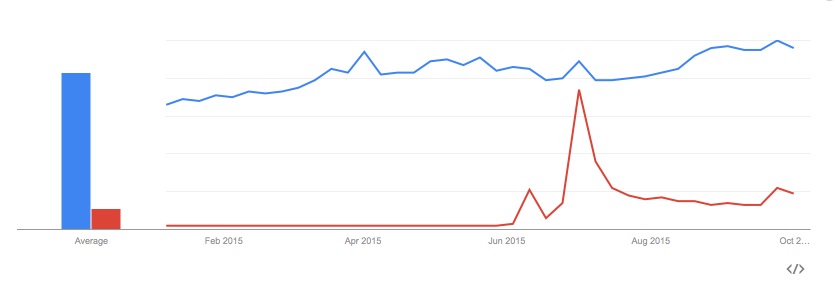

UNITED STATES

Something of a surprise: Apple Music came close to matching Spotify’s popularity on Google in its home territory only once this year – in launch week.

Something of a surprise: Apple Music came close to matching Spotify’s popularity on Google in its home territory only once this year – in launch week.

You’ll also notice that Spotify’s own search frequency jumped up in the week Apple Music landed on people’s phones.

Other than that, Spotify’s brand awareness seems to be evidently way ahead of its rival in the States.

We’ve heard much about Apple ramping up marketing in the US of late, including a special mid-Emmys TV ad featuring Mary J Blige.

That appears to have had some impact, as you can see from the jump up in early October – but it won’t be losing Daniel Ek too much shut-eye.

UNITED KINGDOM

Interesting: ‘Apple Music’ was briefly a more popular search term than ‘Spotify’ in the UK at its launch, in the week between June 28 and July 4.

Interesting: ‘Apple Music’ was briefly a more popular search term than ‘Spotify’ in the UK at its launch, in the week between June 28 and July 4.

Although Apple couldn’t maintain this rash of search popularity, it’s now closer to Spotify as a search term in the UK market than it in the US. (As you can see by comparing the ‘average’ charts from either side of the Atlantic.)

Spotify’s popularity in the UK market was clearly damaged after Apple Music’s launch – note the dip in search frequency from June to September.

However, it’s seen a slight recovery in the past fortnight.

According to Google’s data, out of all the territories in the world, ‘Apple Music’ is actually most popular in the UK on a per-capita basis, followed by Canada, the US, Hong Kong, Norway and New Zealand.

Where do you think Spotify is most searched-for?

In order: Sweden, Norway, Iceland, Denmark, Chile, Mexico and Finland.

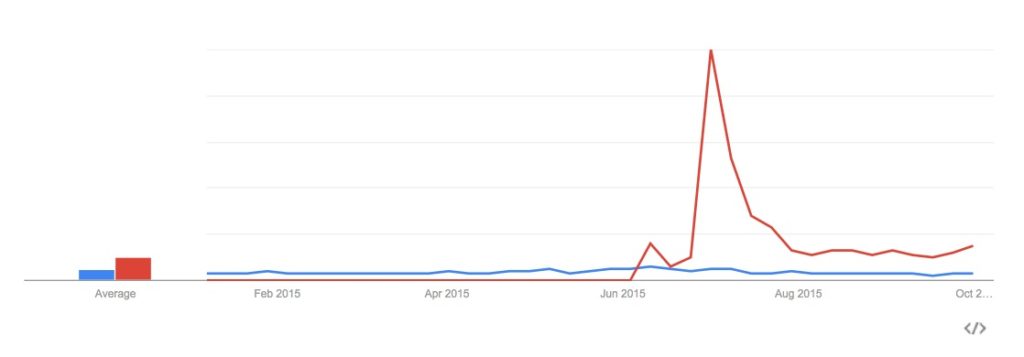

INDIA

An Achilles heel for Spotify, which hasn’t yet launched in India – home to 1.2bn people.

Despite this lack of access, people in India are clearly aware of the Swedish service, which remains slightly more popular on Google than Apple Music.

However, Apple Music – which has officially arrived in India – completely overtook Spotify at launch and is running the search term close as we stand today.

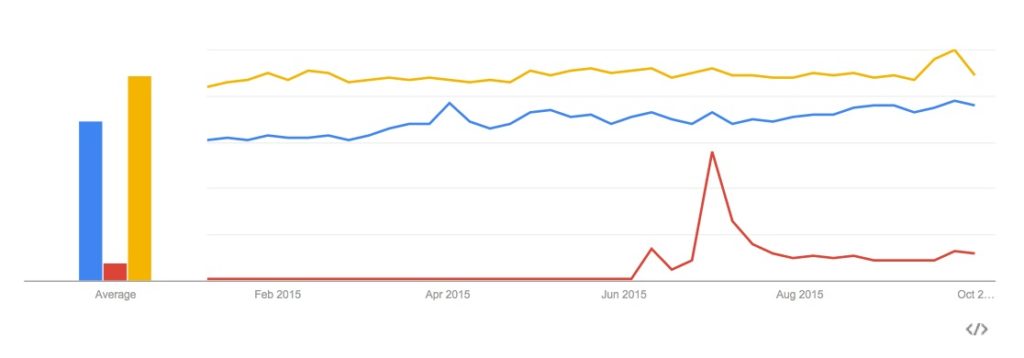

FRANCE

France follows the general international pattern of searches for Apple Music vs. Spotify: there was a peak for Apple around launch, but Spotify remains comfortably ahead.

However, France is also loyal to its homegrown streaming service Deezer which, largely thanks to an ongoing deal with telco Orange, remains the market leader.

Just see what happens when we add Deezer (yellow) into the search data here.

JAPAN

There is at least one major market where Apple Music is tracking ahead of Spotify, and that’s Japan.

Unfortunately for the new service, streaming contributed just 3% of industry revenues in Japan in the first half of 2015, where physical continues to dominate.

AND HERE’S WHY SPOTIFY SHOULDN’T GET TOO COCKY…

All of this could well make Daniel Ek, and those hoping the relative David of Spotify can topple the Goliath of Apple, feel pretty smug.

Yet it needs to be looked at in the wider context of streaming music’s evolution: first, that Apple has still only been in the market for less than four months.

There’s plenty of time to run in this battle for the loyalty of music fans.

Particularly, as MBW noted the other week, because less than 1% of the world’s population are currently paying for an on-demand subscription music service.

That’s a battle that both Apple Music and Spotify will be hoping to fight together.

The yellow line above?

It’s a search term punched in more times than ‘Spotify’ around the world every week.

One that will send a chill down the spines of music industry executives everywhere.

”YouTube to mp3′.