Vessel, the online video platform supported by Warner and Universal which is attempting to charge consumers to access exclusive windowed content before it appears on YouTube, has received US $57.5m in new Series B funding.

The new round of financing is led by Institutional Venture Partners (IVP), joined by existing Vessel investors Benchmark, Greylock Partners and Bezos Expeditions – the personal investment company of Amazon founder Jeff Bezos.

Vessel raised approximately $77 million last summer as it prepared to launch.

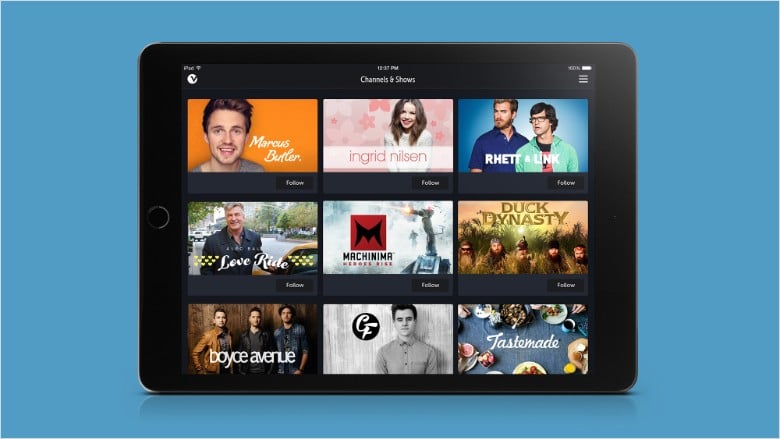

Vessel charges customers US $2.99 per month to gain early access to premium, HD video content from online video stars, including musicians – although users can sign up for free to access Vevo videos from the likes of Taylor Swift, Adele, Pharrell Williams and many more.

It was created by Hulu co-founders Richard Tom (Vessel CTO) and Jason Kilar (CEO)

IVP has previously invested in the likes of Dropbox, Domo, HomeAway, Kayak, LegalZoom, LifeLock, Netflix, Shazam, Snapchat, Supercell and Twitter. 101 of the 300 companies it has invested in have gone public.

“We believe Vessel has the potential to be as successful as these companies someday,” said IVP General Partner Todd Chaffee in a statement.

“If you had to back one team to build the world’s most advanced and user-friendly video platform, this would be the team. Vessel’s founders, Jason Kilar (CEO) and Richard Tom (CTO), are incredibly talented entrepreneurs with a great track record of success. Jason is a visionary media executive who helped Jeff Bezos build Amazon into an e-commerce giant.

“Then, as the founding CEO of Hulu, Jason worked closely with Rich to turn a promising idea into a highly successful global business. Jason and Rich have assembled an exceptional management team, and they have some of the best video engineers on the planet.

“Also, Vessel’s existing investors (Benchmark, Greylock and Bezos Expeditions) are some of the best early stage investors in the venture business. We have enormous respect for these three firms, and we have successfully partnered with them on many occasions. It’s a privilege to work with such a talented team of executives and investors, and we look forward to helping them build Vessel into a highly valuable and enduring company.”

Said Kilar: “We’re thankful to have IVP and this talented group of investors with us on this journey.

“What we are trying to accomplish —creating a video platform that delights consumers and creators alike— is ambitious. Each of these investors brings experience, resources and long-term thinking that will guide us as we continue pursuing our ambitions. Their investment in Vessel will enable us to grow, as a company and a business, equipped with the world-class team and resources we need to make our visions real.”

At Code/Media in February, Lucian Grainge said: “I think [Vessel] is great. The rationale? We create competition within the market.

“It’s another example of what I care about, which is experimenting… for our artists, to create different ways to monetise their work and for us to capture the value in our investment.”

He added: “I think it bodes well for all the other companies that are investing in content and content distribution; whether it’s Apple, Spotify, Deezer, Google or YouTube. I hope it’s successful.” [Music Business Worldwide]