Did you know less than 1% of the world’s population are currently paying for on-demand music streaming services?

The wider industry continues to hope that the likes of Spotify and Apple Music will provide salvation – and early signs from the Nordics and other territories certainly provide reason for hope.

But why are the vast majority of people refusing to put their hand in their pocket for ‘all the music in the world’?

New research out of the US from Nielsen Music brings us closer to the answer.

The research company has conducted what it calls ‘a comprehensive, in-depth study of consumer interaction with music in the United States’ for its Nielsen Music 360 Report – analysing the responses of more than 3,300 US music fans.

The Report covers a range of topics and provides reason to be cheerful: apparently 75% of US consumers now listen to music online in a typical week, for example.

There’s also a shot in the arm for radio.

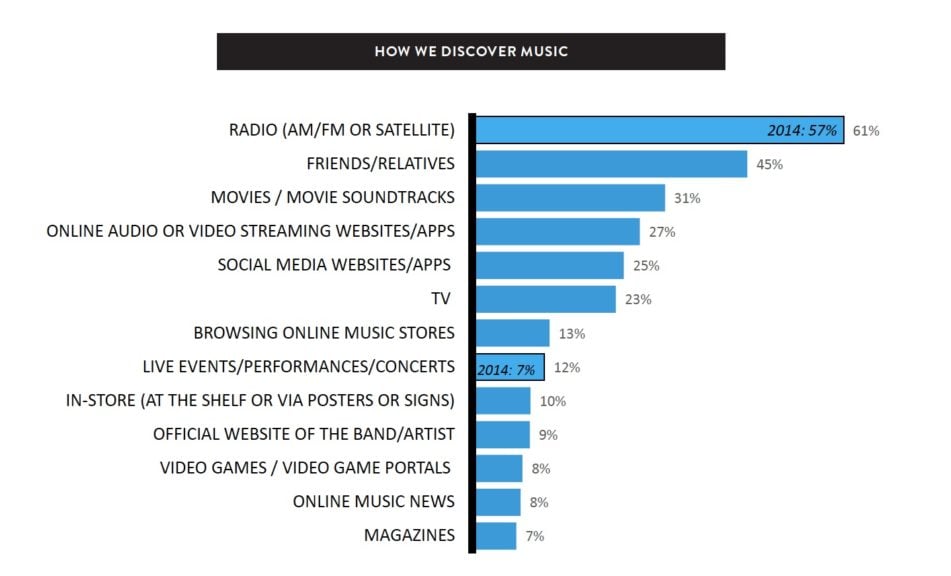

According to Nielsen’s respondents, 61% of people say they discover new music on the wireless today, which has actually increased from the 57% who agreed in 2014.

Meanwhile, streaming services, including YouTube, inform 27% of people about new music.

That’s less than a third of radio’s influence, but also behind the recommendations of friends and family (45%) and movies / movie soundtracks (31%).

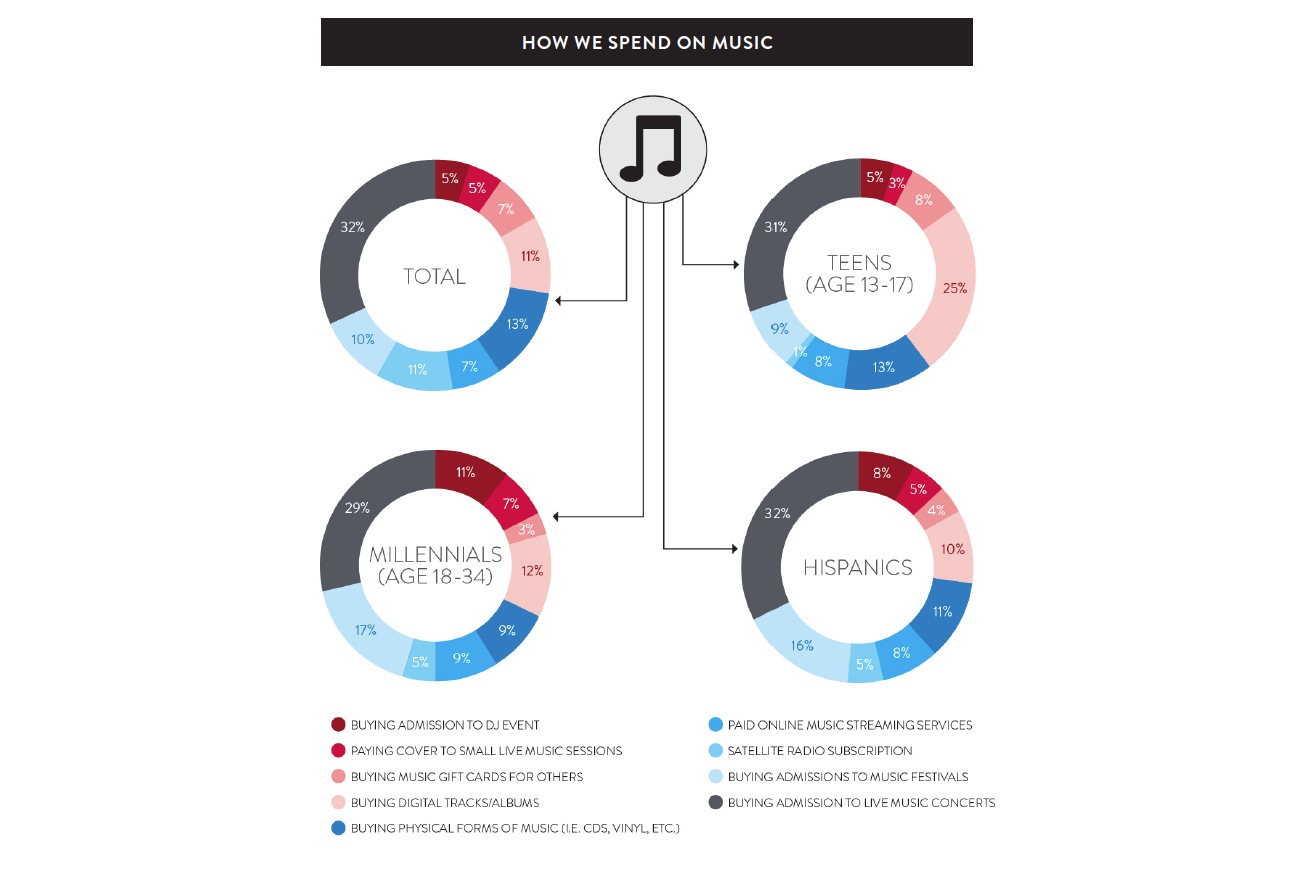

There’s good news too for the growth of on-demand streaming revenues.

The share of this category’s total music spending across Nielsen’s research audience has doubled in the past year to 7%.

Combined with subscription radio services such as Pandora and Sirius XM, this percentage reaches 18%.

Yet as you can see, this category trails way behind live music, which claims 32% of every dollar, or 52% including DJ shows, festivals and small concerts.

Nielsen then directly addresses the elephant in the room: why aren’t more people paying a $9.99 subscription price for streaming?

The ‘under 1%’ stat that started this article, by the way, comes from the fact that out of 7 billion people in the world, just 41m coughed up for an on-demand music streaming subscription last year, according to the IFPI – 0.58% of the world’s populace.

That’s lower than the total number of people paying for a Netflix subscription around the world every month.

Even just in the US, we can deduce that music streaming isn’t exactly flying just yet.

According to the IFPI, paid-for music streaming services accrued $494.7m in the US in 2014. Across a population of 319m people, that worked out at an average of just $1.55 per person.

Another way to slice those figures: $494.7m equates to around 4.1m X $120-per-year subscriptions.

However, as MBW discovered earlier this year, the true monthly revenue generated by the average global Spotify sub in 2014 stood at €5.45 ($6.12) when special offers and telco bundles were applied – or $73.44 per year.

On this basis, there would have been around 6.7m paying on-demand streaming subs in the US last year.

For argument’s sake, let’s use that generous estimate.

It’s the equivalent of 2.1% of the total US population.

Conclusively, then, a streaming revolution is a fair way off right now.

So what’s the hold up?

According to Nielsen, the top three reasons for people refusing to subscribe to a streaming platform are pretty conclusive:

- 46% of people said they are too expensive;

- 42% said they can stream music for free elsewhere;

- 38% said they don’t think they’d use a streaming service enough

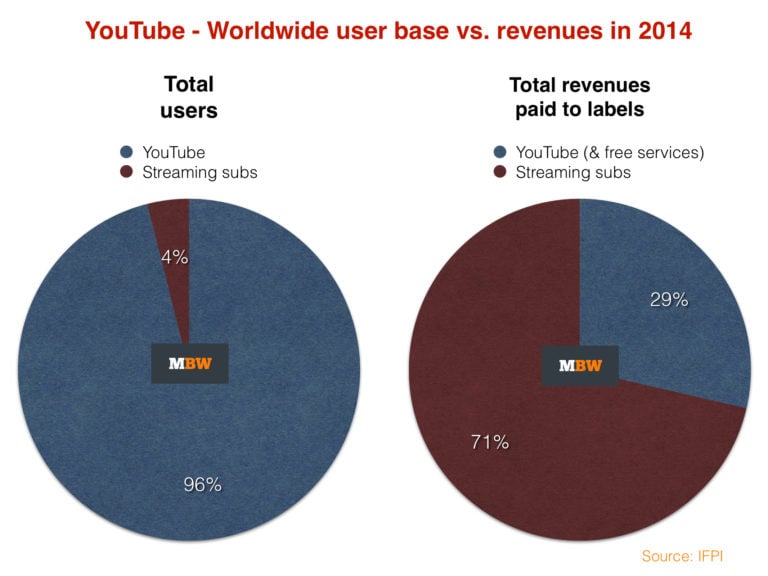

What on earth could those 42% – the ‘stream music for free elsewhere’ mob – be getting at?

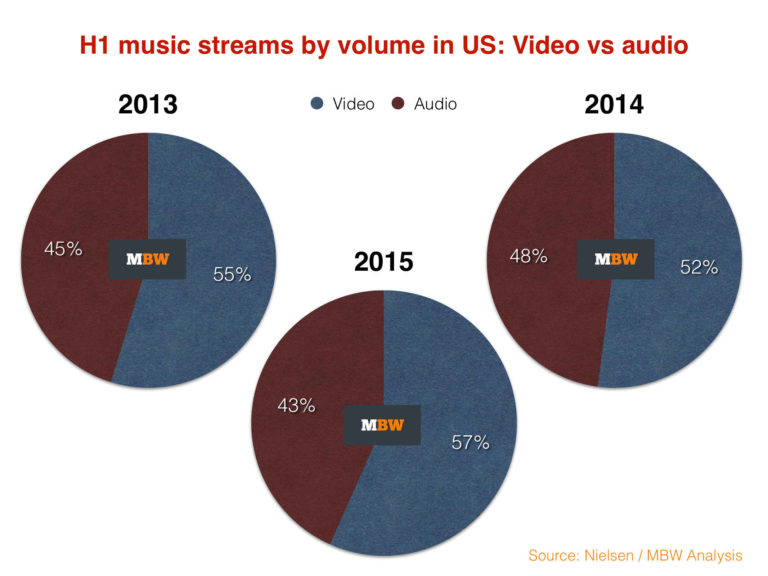

Need we remind you of these two little charts…

It is also worth pointing out the biggest reason Nielsen’s respondents gave forsubscribing to a streaming service:

- 83% said it was the price

The combination of facts above are not unrelated.

Elsewhere in the Nielsen report, non-subscribing music fans were asked how likely it is that they will start paying for an streaming platform in the next six months.

- 9% said it was very or somewhat likely;

- 13% said it was neither likely nor unlikely;

- 78% said it was somewhat or very unlikely

Worth noting that these responses were collected between July and August this year – after the launch of Apple Music’s much-heralded three month free trial.

The music business has its work cut out…