Do major labels really still dedicate a huge chunk of revenue to A&R?

We all recognise that the record industry’s income has withered over the past decade, but what has that done to the amount of cash its biggest players can invest in signing and developing artists?

MBW has crunched Warner Music Group’s historical financial results to try and paint a fair reflection.

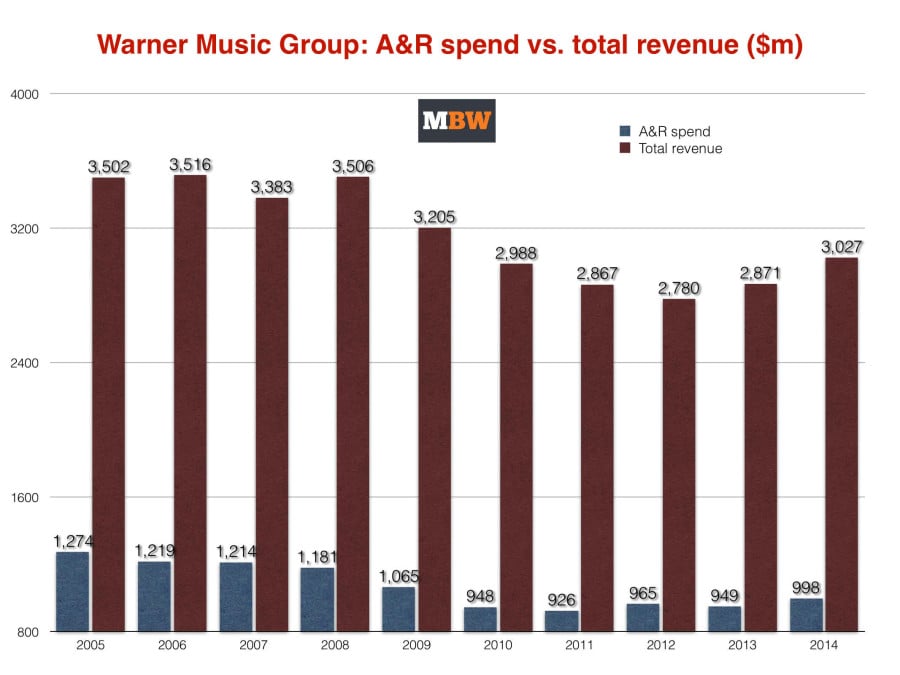

Firstly, there’s no getting away from the expected erosion in the company’s A&R spend across its labels, which include Atlantic, Warner Bros and Parlophone.

In the decade between FY2005 and FY2014 (inclusive), its annual A&R investment fell by 21.7% to US $998m.

(These represent WMG’s fiscal years, generally running from end of September the prior calendar year, and refer only to its recorded music operation.)

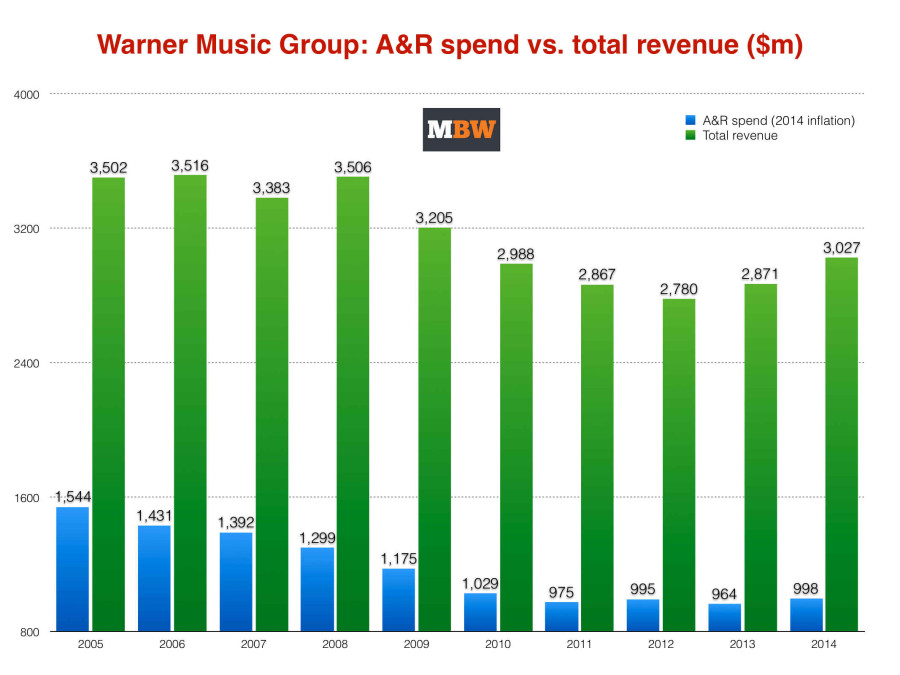

Consider these costs at 2014 inflation, and the ten-year fall was even more severe, down 35.4%.

In 2014 Warner’s A&R investment was at its highest for five years – 7.7% higher than the rock bottom of FY2011, when it spent $926m on artists.

WMG’s acquisition of Parlophone Label Group for £487m in July 2013 will have played a key role in this rise.

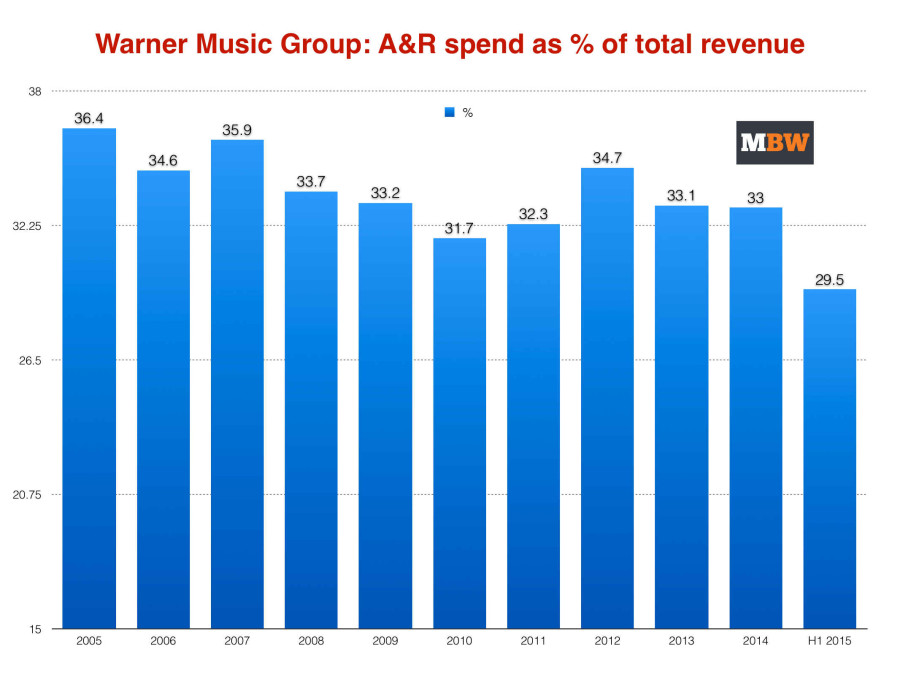

Now let’s look at these figures a slightly different way, as a percentage of total revenue – effectively telling us how much Warner Music Group values A&R in each given year.

In this context, there have been three significant peaks in the past decade: FY2005 (36.4%), FY2007 (35.9%) and FY2012 (34.7%).

What’s also interesting is the fact that there hasn’t been any steady pattern of decline.

Although average A&R spend as a % from FY2010 to FY2014 is certainly down on the previous five years, it shows peaks and troughs.

So far in its FY2015, Warner has spent… $292m on A&R in its Q1 (against revenue of $829m) and $203m in Q2 (against revenue of $677m).

This averages out at an A&R spend as a percentage of total revenue in the six months to end of March of 29.5%.

Warner defines its A&R expenditure to investors as: ‘The costs associated with (i) paying royalties to artists, producers, songwriters, other copyright holders and trade unions, (ii) signing and developing artists, (iii) creating master recordings in the studio and (iv) creating artwork for album covers and liner notes.’

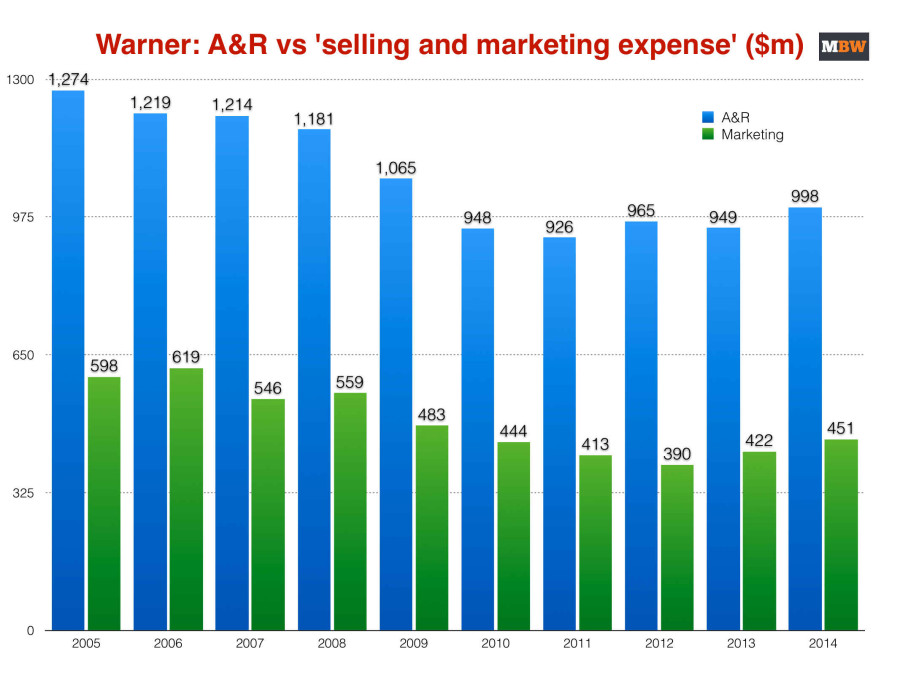

Another interesting way to slice the figures is to see how that outgoing compares to another notorious major label expense: marketing.

Warner publicly reports its recorded music “selling and marketing expense” each fiscal year, which gives us some insight.

Here’s how that cost stacks up against A&R:

In FY2014, Warner’s marketing spend was 45% of the size of its A&R spend, a fraction ahead of FY2013.

In FY2012, though, that figure dropped to just 40%, a fall from the 44.6% of FY2011.

Going all the way back to FY2005, the annual price of marketing at WMG was 47% of A&R, while in FY2006 it was up to 51%.

Which just goes to show… if Warner’s figures are to be trusted, both marketing and A&R spend at the major label have notably fallen as the industry has contracted over the past decade, despite its ingestion of Parlophone Label Group in 2013.

But, overall, Warner actually appears to have protected its A&R spend more than it has its promotional warchest. [Music Business Worldwide]