Bruce Warren, program director for the University of Pennsylvania’s musically adventurous public-radio station WXPN, says he’s “loving Beats 1,” Apple’s 5-week-old digital radio station. But, he adds, he doesn’t understand the media’s fascination with the service’s human-curated, DJ-hosted format. “There are a lot of cool radio stations around the world that are doing that on any given day,” he says. “It’s like, ‘Wake the f– up, hipsters!'”

The idea may be essentially as old as commercial radio itself, which began in the 1920s, but as the centerpiece of Apple’s latest gambit to evolve as music consumers shift from downloads to streaming, Beats 1 puts a fashionable new spin on the medium and, ideally, will serve as a loss leader and gateway drug for Apple’s $9.99-a-month subscription streaming service.

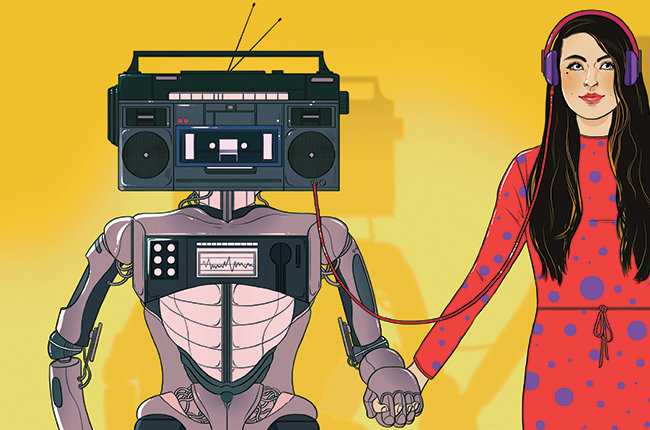

Born out of the company’s $3 billion acquisition of Beats Electronics in 2014 and a successor to Apple’s Pandora-like iTunes Radio, Beats 1 revolves around a stable of chatty, enthusiastic DJs led by BBC Radio 1 alumnus and music trendsetter Zane Lowe, and supplemented by artists such as Drake, St. Vincent, Elton John, Queens of the Stone Age frontman Josh Homme and even Beats co-founder Dr. Dre. The effect, amplified by social media, is that old-fashioned sensation of many people tuning in at once — a communal experience in a digital realm where personal customization is the norm.

Apple certainly isn’t the first to humanize online radio, just as it wasn’t the first to invent the MP3 player, but if the roughly $700 billion company can create as much excitement about Beats 1 as it has over iPhones, it could popularize digital radio in a way that would directly challenge the format’s largest entities, Pandora and SiriusXM. (Although the latter is commonly tagged as satellite radio, it charges a separate fee for its online streaming service, which offers exclusive programming.)

“The brilliant thing about Beats 1 is that it manages to project a very non-mainstream vibe when it is in fact under the umbrella of a very mainstream company,” says Bridget Herrmann, Midwest radio promotion manager for Crush Music (Weezer, Fall Out Boy, Sia, Ashley Monroe). “And in spite of Apple being that very mainstream company, it has maintained its persona of the hip, cool brand by being innovators in its field. Beats 1 gives off the same vibe because, as far as digital radio goes, it stands alone at the moment in what it’s doing with music, guest DJs, interviews and overall format.”

It is already building a reputation as a destination for exclusive music premieres and breaking news. In late July, Drake premiered three new songs on his OVO Sound show including “Charged Up,” a response to friend-turned-rival rapper Meek Mill‘s accusations that he doesn’t write his own rhymes. Then, at the beginning of August, Dr. Dre demonstrated one way that Beats 1 will funnel customers to Apple Music’s for-pay site when he announced on his show The Pharmacy that he would be releasing his first album in 15 years, Compton, in conjunction with the new N.W.A biopic Straight Outta Compton. The album is available exclusively on Apple Music.

Beats 1 enters the market at a time of growth for digital broadcasting. Although terrestrial radio still dwarfs its online equivalent — according to Nielsen Audio, 93 percent of U.S. adults listened to AM or FM at least once a week in June — the gap is closing. Between 2000 and 2015, the weekly U.S. reach of online radio has grown from 2 percent of the U.S. population age 12 and older to 44 percent, according to Edison Research and Triton Digital. That number rises to 69 percent among 12- to 24-year-olds. From 2013 to 2014, streaming revenue also jumped from 21 percent to 27 percent of total retail music sales, which was nearly $7 billion in 2014, according to the RIAA. The organization also reports U.S. paid streaming subscriptions more than tripled from 1.8 million in 2011 to 7.7 million in 2014.

The recent reveal by Apple senior vp Internet software and services Eddy Cue that 11 million people have signed up for a free three-month trial of its new streaming service signals a promising start. But Pandora, which boasts more than 79 million active monthly U.S. users, downplays the idea of Beats 1 as a threat. “That kind of curation has been around forever,” says Pandora co-founder/CEO Tim Westergren, who points out that Pandora’s Music Genome Project curates music using a cadre of analysts who classify songs by as many as 450 different musical attributes.

Pandora is designed to be a personalized experience as opposed to a social one, facilitated by its listeners’ nearly 60 billion “thumbs up” or “thumbs down” responses to songs. There are also no DJs talking over the music. “We try to avoid too much personality on the service; we want an individual to feel like it’s theirs,” says Westergren. “Our ethos is fundamentally less about tastemaking — ‘this [DJ] is smarter than you.’ We shy away from that.”

Other rivals similarly dismiss human curation as unique to Beats 1. “We have believed in the human approach from the very beginning and have now built a national music platform with more than 30 million subscribers in North America,” says Steve Blatter, head of music programming for SiriusXM, which carries 175-plus channels, more than 72 of which are music-oriented. (The rest feature news, comedy, sports and talk.) “Curation is only an entry point and is fast becoming a commodity. Even my 4-year-old curates his own playlists.”

Owen Grover, senior vp/GM for iHeartMedia’s digital radio platform iHeartRadio, which counts more 2,000 live radio stations and 70 million registered users of its custom stations , contends that the company formerly known as Clear Channel is digital radio’s original curator. “I’d argue that our human-led approach highly influenced Beats 1,” he says. His assertion is challenged by Slacker CEO Duncan Orrell-Jones, who insists that “no one else” besides his online radio company was blending “great curated music and personality” prior to Apple’s entry. (Apple executive Jimmy Iovine and Apple Music senior director Ian Rogersdeclined to comment for this story.)

From there, digital audio purveyors’ approaches to the medium vary. Spotify, with more than 75 million active users, continues to tout human-curated “lean-back” features — in which the listener only needs to click on a playlist or type in an artist or genre — like its just-launched Discover Weekly custom playlists. Fellow on-demand services Tidal and Google Play Music rely on the human touch as well, albeit sans live DJs.

Last September, Rdio foreshadowed Beats 1 by adding a free online-radio component — that uses algorithms and human curation but not DJs — to its on-demand service, and on Aug. 12, it rolled out digital feeds for almost 500 Cumulus Media live-broadcast stations. Apple, meanwhile, reportedly has secured licensing deals with labels that grant the tech giant permission to establish up to five additional digital stations without having to renegotiate.

Whether Beats 1 becomes Apple’s next Ping — the flop social networking service supplanted by Apple Music’s Connect — or a chic HBO to SiriusXM’s Comcast will depend not only on listenership but on the station’s clout with labels. And there are early indications that Lowe and company are selling records.

While label executives say Beats 1 is still finding its place within the Apple ecosystem and record promoters are still figuring out the best way to plug their product there, when Lowe spotlighted “Boys in the Street,” New York singer-songwriter Greg Holden’s poignant song about a father’s troubled relationship with his gay son, as a “Beats 1 World Record,” weekly sales of the title jumped from 150 units to more than 600, according to Warner Bros. Records.

In other good news, these same sources say Beats 1 and Apple Music so far have not accelerated the decline of iTunes downloads, a widespread fear among polled label executives. (U.S. download sales reportedly fell 11 percent in 2014, according to Nielsen Music.)

“Beats 1 hopefully is going to be a new way not just to drive sales, but to break artists,” says Crush’s Herrmann, who adds that after listening to the station for the first time, she bought three songs by artists she’d never heard. If Beats 1 can spur more transactions like that with a fraction of the 800 million credit cards Apple has on file, there’s no ruling out the possibility of Beats 2 — or Beats 100.